Acquisition Rule: One or Three Year Audit

Both PEIs and strategic buyers alike are frequently faced with the question of how many years of a target’s financial statements are needed for the deal. Public strategic buyers have to comply with SEC Regulation S-X, Rule 3.05 (Rule 3.05), which requires them to provide financial statements for significant consummated or probable business acquisitions. The significant acquisition rule focuses on three principle criteria: the investment test, the asset test, and the income test. If any of those tests exceeds a threshold of 20%, at least one year of audited financial statements (and potentially up to three if any of the tests exceeds 50%) will be required. In addition, financial statements for probable acquisitions that exceed a 50% significance threshold will also be required.

Navigating the Waters of the SEC—An M&A Perspective

Timeline of Events for Audit

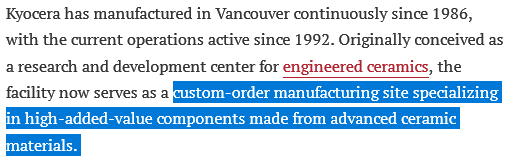

May 2016 – Change in Audit firms by acquisition. As you can see BDO just absorbed Mantyla into its network of CPA offices throughout the world. Mantyla would continue to operate as usual with the BDO name and would operate with the full resources of BDO. Mantyla had been under BDO’s umbrella since joining the BDO Alliance in 2008. This was just the next step in their relationship for Mantyla but strategic for BDO.

Chicago, IL – BDO USA, LLP, one of the nation’s leading professional service organizations, today announced an expansion into the Utah market through the addition of 64 staff, including 10 partners, from Mantyla McReynolds, LLC. Founded in 1989, Mantyla McReynolds provides a full range of accounting and consulting services to a diversified client base of public and private businesses. The firm has significant strength in the technology and life sciences, real estate, hospitality and entertainment, equipment leasing, outdoor recreation and ski resorts, auto dealerships, and manufacturing and distribution industries. Based in Salt Lake City, the firm has been a member of BDO Alliance USA since 2008. The combination of BDO and Mantyla McReynolds is subject to customary closing conditions and is expected to be completed on July 1, 2016.

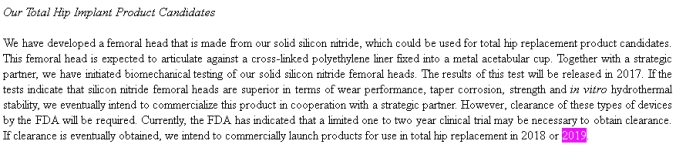

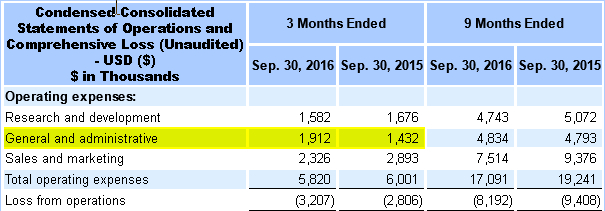

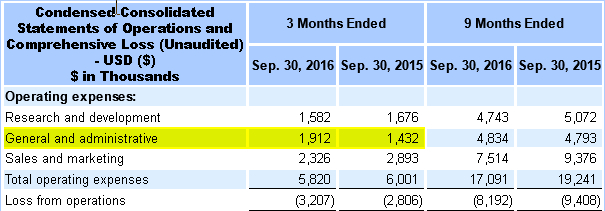

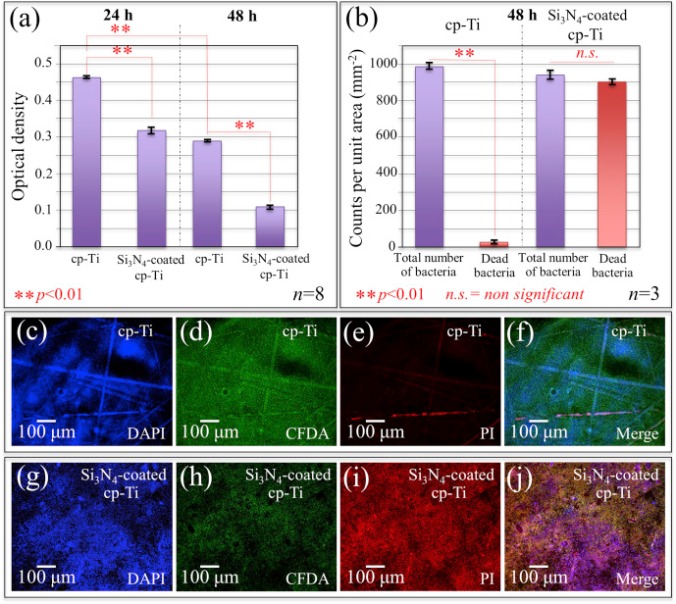

Q3 2016: It appears at some point Q3, Amedica paid BDO upfront $485,991 (pg 72) in audit fees as there was a corresponding spike in G&A fees of $480,000 (pg 4) over 2015.

October 4th, 2016

| (b) |

In connection with Amedica’s staff reduction, Ty Lombardi, the company’s Chief Financial Officer and Principal Financial Officer, left the employ of the company. |

|

|

| (c) |

Effective October 4, 2016, B. Sonny Bal, MD, has been appointed to serve as the company’s Principal Financial Officer. Dr. Bal currently serves as the company’s President and Chief Executive Officer and Chairman of the Board. |

Take note of this, because it will be brought up again later. Fast Forward to March 31st, 2017 and the first notification of an audit is revealed with the filing of Amedica’s first NT-10K filing.

Amedica Corporation (the “Company”) has not yet completed certain financial and other information necessary for an accurate and full completion of the Annual Report

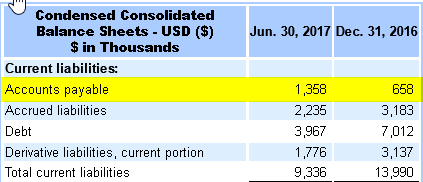

Q2′ 2017: Amedica incurs an increase in Accounts Payable expenses of 700k Q2’17 as compared to Q2’16. Likely related to audit costs incurred during the ongoing audit in 2017.

This is then followed by a 10-Q/A on April 19th, 2017:

Sole purpose of this Amendment No. 1 is to correct the condensed consolidated statements of operations

That same day we also find out that the delay in filings was due to:

The Company requires additional time to fully consider whether there is any potential impairment in relation to certain of its long-lived assets. Management and the Audit Committee of the Company’s Board of Directors are continuing to work diligently to complete its Annual Report on Form 10-K for the fiscal year ended December 31, 2016 and file it with the SEC as soon as possible.

Amedica Announces Delayed Filing of Annual Report on Form 10-K and Receipt of Nasdaq Letter

NT filings followed for Quarter 1 & Quarter 2 before submission of 2016 10k September 20th, 2016. Also filed with 2016’s 10k, Amedica announced it has let BDO go and has retained the services of Tanner, LLC to oversee audit of 2017’s financials.

On September 20, 2017, Amedica Corporation (the “Registrant”) informed BDO USA, LLP (“BDO”) of their dismissal as its independent registered public accounting firm. The dismissal was authorized by the Audit Committee of the Registrant’s Board of Directors. On the same date, the Audit Committee engaged Tanner LLC (“Tanner”) as the Registrant’s independent registered public accounting firm for the fiscal year ending December 31, 2017.

Quarter’s 1 & 2 follow October 31st, which also happened to be the deadline given by NASDAQ or face delisting. Quarter 3 was submitted on it’s due date as well, November 14th, 2017, maintaining compliance with Nasdaq.

December 11th, 2017 – Amedica announces that all of 2017, 2016 10k, & Q3’16 financial statements are no longer worthy of being relied upon.

On December 8, 2017, the Audit Committee of the board of directors of Amedica Corporation (the “Company”), following discussions with management, concluded that the Company will restate the audited consolidated financial statements contained in its annual report on Form 10-K for the year ended December 31, 2016, as well as the unaudited condensed consolidated financial statements contained in its Quarterly Reports on Form 10-Q for the quarters ended September 30, 2016, March 31, 2017, June 30, 2017, and September 30, 2017. Accordingly, the financial statements contained in these reports should no longer be relied upon. Further, the Audit Committee concluded that the Report of the Independent Registered Public Accounting Firm for the year ended December 31, 2016 should no longer be relied upon. The Company intends to present the restated financial statements and other financial data in amendments to its Annual Report on Form 10-K for the fiscal year ended December 31, 2016 and its Quarterly Reports on Form 10-Q for the quarters ended September 30, 2016, March 31, 2017, June 30, 2017, and September 30, 2017, (the “Restated Filings”)

Three Years Audited financials: 2015, 2016, 2017 in Progress

We now know that 2017 is currently being audited, 2016 was audited but will see further restatement, & 2015 was audited along with 2016 with a minor change being made to 2015’s Balance Sheet. I highlighted the change from original Balance Sheet.

As i said, the change is relatively minor which explains why they didn’t feel the need to issue a restated financial statement. Its funny that all the problems came after the company let its CFO go and used outside services to assist in preparation of their financials. However the most intriguing part was only recently disclosed in the companies 10K/A.

Audit fees for 2016 saw a significant jump in costs after BDO acquired Mantyla. Its odd, that BDO would charge so much more than Mantyla when the same employees would have worked on Amedica’s financials.

On average, typical audit fees are 1.04% of revenues. Amedica’s revenue for 2016 was $15.23 million which equates to ~$158,000. Amedica’s 2015 fees are actually less than the average fee per million in revenue. What about BDO average cost? In 2013, BDO had approximately 157 small business clients in the following article, Audit Fees for Smaller Reporting Companies.

Taking $29,818,114 and dividing it by 157 clients, you get an average cost of $189,622. Factoring in inflation that means BDO’s average cost should be ~$210,000 now or approximately 25% premium over Mantyla’s cost. Why then is BDO’s cost $486,000 for 2H16? Certainly it has to do with the audit of Q3’16 financials due to the error in the filing? The problem with that line of thinking is that Q3’16 financials were not filed until mid November. That means in the span of 45 days, BDO managed to accumulate a 135% increase over its usual ANNUAL fee. Not only that, but Q3 audit did not complete until April of this year meaning the costs for an audit of Q3’16 is even greater than the $486,000 reported. I wonder what their total audit fees will be in 2017.

To put this into context, Amedica’s audit fees (pg 19) for its IPO was $1.2 million with 2016 fees equating to 40% of that. Since i do not have audit experience and am unfamiliar with the full costs i thought i would compare this to a few other companies that BDO has done audits for.

Update:

10-3Q/A 2016 Amedica saw a spike in general & administrative costs of $480,000 compared to Q3’15. From July 19th, 2016 – December 31st, Amedica paid BDO, LLP $485,991 suggesting that Amedica prepaid BDO for the audit 2H16 BEFORE both the CFO left the company & before the misstatement was caught on Q3’16 financials.

10-Q2/A 2017 Amedica incurred an increase in accounts payable of exactly 700k over 2016.

The only explanation for this spike in AP is, at least partially, the cost incurred from the ongoing audit 2017. The full amount would bring the total estimated costs of the audit that began Q3’16 to $1,185,991 compared to Amedica’s IPO audit costs of $1,187,300.

ANTHERA PHARMACEUTICALS, INC.

March 2014 Athera Pharmaceuticals announced that it too had to restate its financials due to failure to book warrants correctly.

On March 10, 2014, in connection with an internal review initiated by the Company of the accounting for certain warrants issued in conjunction with an equity offering in September 2010, the Company, in consultation with its Audit Committee concluded to restate its previously issued financial statements for the years ended 2010, 2011 and 2012, including inception to date ended December 31, 2012, and the unaudited quarterly financial information for the first three quarters of 2012 (“Affected Periods”) because of a misapplication in the guidance around accounting for the warrants and that such financial statements, with the accompanying independent auditors report, as applicable, should no longer be relied upon.

Three years of annual financials statements had to be restated along with 2012 quarterly financials. How much did this end up costing Anthera? To answer this, we should first take note that Anthera engaged BDO as its independent audit firm August 2013. The total costs for BDO in 2013 was $211,257. In 2012, Anthera’s audit fees were only $216,005. So BDO’s fees for 2013 were right on par with Athera’s previous year. Maybe the error wasn’t caught until 2014? Sure enough, 2014’s audit fees spiked to $368,450 or an increase of 75%. Mind you, this was for the entire year of 2014. In July of 2014, Anthera announced it had acquired Sollpura from Eli Lilly. It also sub licensed the drug to its subsidiary:

Anthera intends to sublicense all rights, obligations, and intellectual property for the development and commercialization of Sollpura to Alkira Therapeutics, Inc. (“Alkira”). In the future, Alkira will secure appropriate funding as a wholly-owned subsidiary of Anthera to advance Sollpura into a phase 3 pivotal registration trial as agreed with the United States Food and Drug Administration in 2013. It is intended that Alkira will make all future contingent milestone payments under the license agreement upon product approval and on certain annual sales achievements and will make royalty payments on any product sales after achieving certain sales thresholds of cumulative net sales of Sollpura.

After 2014, Anthera’s audit fees only increased due to more complicated nature of its consolidated financials and likely contributed to the 75% increase in audit fees for 2014.

InfuSystem Holdings, Inc

On November 1, 2016, the Audit Committee of the Board of Directors of InfuSystem Holdings, Inc. (the “Company”) concluded, after review and discussion with management and the Company’s independent registered public accounting firm, BDO USA, LLP (“BDO”), that the Company’s audited financial statements for the fiscal year ended December 31, 2015, and the Company’s unaudited financial statements for each of the fiscal quarters ended March 31, 2015 through June 30, 2016 (collectively, the “Financial Statements”) should no longer be relied upon. The Financial Statements contained an error related to an overstatement of estimated accounts receivable collections which in turn overstated revenues and pre-tax income by a corresponding amount.

InfuSystem restated its 2015 10k along with the first 2 quarters of 2016 1 month later. Total cost for audit 2016 was $663,835 up from 2015 $546,154. Overall that’s an increase of just 22% over 2015.

Like Anthera, there was an underlying trigger for the audit:

June 19 (Reuters) – Infusystem Holdings Inc

* 22Nw fund lp – transmitted a letter to board of infusystem holdings inc. To acquire all outstanding shares of infu for $2.00 per share

* 22Nw fund lp – proposal is an all cash offer Source text for Eikon: Further company coverage:

Just like Anthera acquisition of assets triggered the audit by BDO but in Infusystem’s case it was another company trying to acquire their assets.

TerraForm Power, Inc

I saved the best example for last. This research was compiled by CL101 and posted on ihub at this link. The paralleled events are uncanny.

Ticker = TERP

https://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001599947&type=&dateb=&owner=exclude&count=40

1. AMDA had “NT” Filings … They also had “NT” Filings:

NT 10-K = 2016-02-29

NT 10-Q = 2016-05-11

NT 10-Q = 2016-08-10

NT 10-Q = 2016-11-10

2. No Annual Meeting in 2016 = No DEF 14A = Same like AMDA in 2017!

https://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001599947&type=def+14a&dateb=&owner=exclude&count=40

3. No CFO too = 15 months prior to M&A event, they said “Adios!” to their CFO … 1 executive took 2 jobs like Sonny (CEO & CFO):

“Mr. Alejandro Hernandez was removed as Executive Vice President and Chief Financial Officer of the Company and Mr. Manavendra Sial was appointed to serve as interim Chief Financial Officer of the Company.”

“On November 22, 2015, Ms. Rebecca Cranna was appointed to serve as Executive Vice President and Chief Financial Officer of the Company on a permanent basis, and Mr. Sial correspondingly stepped down as interim Chief Financial Officer of the Company.”

https://www.sec.gov/Archives/edgar/data/1599947/000159994716000244/terp201510-k.htm

14+ months ago, AMDA’s CFO “Adios” as well:

“In connection with Amedica’s staff reduction, Ty Lombardi, the company’s Chief Financial Officer and Principal Financial Officer, left the employ of the company.”

https://www.sec.gov/Archives/edgar/data/1269026/000149315216013858/form8-k.htm

CFO surplus on the job market, why?

https://www.wsj.com/articles/merger-boom-spawns-a-cfo-surplus-1433808509

4. $1.7 Billion Market Cap company had this issues:

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company’s annual or interim financial statements will not be prevented or detected on a timely basis. The following material weaknesses have been identified and included in Management’s Report on Internal Control over Financial Reporting:

•

Ineffective Board oversight and management monitoring activities over the information technology systems development and implementation of financial reporting processes and internal controls by the parent company service provider;

•

Insufficient number of trained resources with assigned responsibility and accountability for financial reporting processes and internal controls conducted by the parent company service provider;

•

Ineffective risk assessment process that responds to changes in generally accepted accounting principles, changes in its business operations, modifications to information technology systems, and changes within the parent company service provider and key personnel;

•

Ineffective information and communication processes that ensure appropriate and accurate information is available to financial reporting personnel on a timely basis;

•

Ineffective monitoring activities;

132

•

Ineffective general information technology controls over the consolidation and Solar segment operating systems, databases, and IT applications and ineffective access controls over the Wind Segment operating system, databases, and IT applications, both resulting in ineffective process level automated controls and compensating manual controls dependent upon the information derived from relevant IT systems;

•

Ineffective controls over the completeness, existence, and accuracy of: (i) revenues and accounts receivable transactions (ii) allocated general and administrative expenses, (iii) the transfer of historical costs related to renewable energy facilities acquired from the parent company;

•

Ineffective operation of reconciliation controls over the completeness, existence and accuracy of various balance sheet accounts;

•

Ineffective controls over the completeness and presentation of restricted cash; and

•

Ineffective controls over the completeness and accuracy of information used as part of goodwill impairment, business combinations, hypothetical liquidation of book value, debt covenant compliance, and going concern processes.

https://www.sec.gov/Archives/edgar/data/1599947/000159994716000244/terp201510-k.htm#se7f57f2b8e904090afadcbdde851baf1 (Page 132 – Page 133)

I won’t be surprise that a tiny nano-cap like AMDA has the same issues too…not a big deal at all.

5. Principal Accounting Fees and Services.

Year ended December 31, 2014 = $ 1,608.9 in (1000s) = $ 1,608,900

Year ended December 31, 2015 = $ 10,141.0 in (1000s)= $10,141,000

*** 2015 increased more than 6X compared to 2014 ***

https://www.sec.gov/Archives/edgar/data/1599947/000159994716000244/terp201510-k.htm#se7f57f2b8e904090afadcbdde851baf1 (Page 130)

Year ended December 31, 2016 = $ 8,498.4 in (1000s) = $ 8,498,400

…

* TERP filed 10-K = Dec 6th, 2016 … really late (w/ Executive Compensations Disclosure for 2015 fiscal year)…obviously their books & records were complicated than AMDA’s.

* They filed their 2016 – 3rd Quarter Financial Statement = 2017-02-24 (WAY OVER DUE = rolled over to the next fiscal year = 2017! AMDA filed 3Q ER 11 weeks earlier than them as in comparison)

* 10 plus days after they filed 3Q ER, they announced the M&A news:

https://www.sec.gov/Archives/edgar/data/1599947/000156761917000392/0001567619-17-000392-index.htm

Then they filed DEFM14A to vote on the M&A.

*** 10-Q/As should be out soon or even out the same day w/ M&A news ***

@ As you can see, there are similarities in terms of events between AMDA & TERP @

As CL101 shows, the events that transpired at TERP are pretty much exactly like Amedicas. Even had the same material weaknesses despite it being a billion dollar company to Amedica’s 9 million marketcap. They also let their CFO go over a year before announcing M&A. CFO is a redundant position when you have external parties combing through your books; not to mention target CFOs are not usually needed because acquiring company already has one.

Conclusion

As you should be able to see audits of this nature are usually triggered by an event not yet disclosed. The more thorough the audit the more expensive it will be. There are two primary causes for more in-depth and expensive audits, when a company first goes public or when a company mergers into another. I doubt tender offers require as extensive of audits because the target company’s books will no longer be needed. Amedicas audit is obviously expensive, rivaling the cost of its audit when it went public; 40% of IPO costs seen in 2H16 and the audit is still ongoing with up to an additional 700k incurred 2017.

Anthera was auditing its books to both create a subsidiary and to acquire an asset. In both Infusystems & Terraform Power’s cases the audits were triggered because interested party was trying to acquire them. Infusystems audit was not thorough at all based on the small increase in audit costs. Terraform however saw significant increase in audit costs in 2015 & 2016 when Brookfield Asset Management acquired 51% stake in them. All the evidence i and others have compiled clearly show Amedica is getting itself ready to merge with Zimmer-Biomet and that’s the cause of this expensive thorough audit!

- 3 year audit of financials

- Almost no debt or any real liabilities with enough capital in warrants to close shop

- Clean capital structure with small share count that will minimally impact acquiring companies EPS.

- Close to operational black and vastly improved EPS (only -.68 per share post RS) to date.

- Greater operational efficiency that has allowed for improved EPS while revenues have declined (all about margins!)

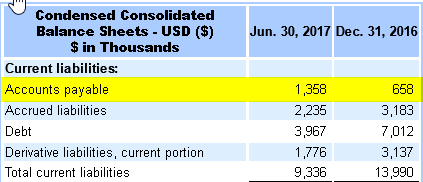

- Significantly de-risked IP through 10 years of clinical use, 2 clinical trials, and some 60+ odd scientific publications showcasing the clinical benefits of Silicon Nitride

Check out these two recent publications:

Surface topography of silicon nitride affects antimicrobial and osseointegrative properties of tibial implants in a murine model.

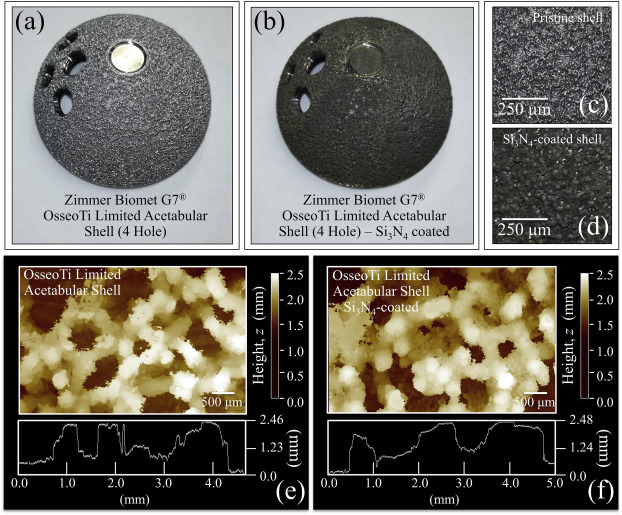

Moreover, SEM imaging demonstrated that MRSA cannot directly adhere to native as-fired Si3 N4 . Subsequently, a cross-sectional study was completed in which sterile or MRSA contaminated as-fired and machined Si3 N4 implants were inserted into the tibiae of 8-week old female Balb/c mice, and harvested on day 1, 3, 5, 7, 10, or 14 post-operatively for SEM. The findings demonstrated that the antimicrobial activity of the as-fired implants resulted from macrophage clearance of the bacteria during biofilm formation on day 1, followed by osseointegration through the apparent recruitment of mesenchymal stem cells on days 3-5, which differentiated into osteoblasts on days 7-14.

Human osteoblasts grow transitional Si/N apatite in quickly osteointegrated Si3N4 cervical insert.

Si and N elements stimulated progenitor cell differentiation and osteoblastic activity, which ultimately resulted in accelerated bone ingrowth. (important in regards to Porous Silicon Nitride)

Identical analyses conducted on a polyetheretherketone (PEEK) spinal explant showed no chemical changes and a lower propensity for osteogenic activity. Silicon and nitrogen are key elements in stimulating cells to generate bony apatite with crystallographic imperfections, leading to enhanced bioactivity of Si3N4 biomedical devices.

Data show that the formation of hydroxyapatite on silicon nitride bio-ceramic surfaces happens with a peculiar mechanism inside the human body. Silicon and nitrogen were incorporated inside the bony tissue structure allowing the developing of off-stoichiometric bony apatite and stimulating progenitor cell differentiation/osteoblastic activity.

Commentary

There are a few individuals claiming there is nothing to see here other than a company in a complete mess. However the evidence i and others have compiled show something else entirely. It seems like some want to disguise Amedica as being a POS company when it fact its nothing of the sort. Amedica is the epitome of a diamond in the rough! I’ve been trying to wipe off the coal dust to show the world the diamond that awaits just beneath the surface.

Amedica’s Si3n4 could completely change the world of orthepeadics with it’s natural ability to essentially feed bone growing cells and its ability to prevent bacteria growth or even kill bacteria like MRSA.

This should be my last post about Amedica unless there is some other major revelation discovered. After M&A is announced i’ll post an email address to contact me and some other information. Amedica is the first company i have profiled but they will not be the last. I will also maintain coverage of Silicon Nitride after Zimmer M&A with Amedica because I believe in the tech and its future in orthepeadics and its potential uses in bio-electronics! I ‘ll be on the look out for other technologies and companies to profile into the future. In fact ill briefly touch on an upcoming tech after M&A is announced here.

For now, I wish everyone reading Happy Holidays and a wonderful New Year!

For access to all my posts about Amedica, Zimmer, & Silicon Nitiride go here:

Index Page

Pattern 1 The university hosts a researcher from a private company and collaborative research on a subject of mutual interest is conducted on campus.

Pattern 1 The university hosts a researcher from a private company and collaborative research on a subject of mutual interest is conducted on campus.