First quarter 2016, CEO Dr. Bal laid out 4 major objectives he has for the company and 3 of them are oriented around de-risking the company.

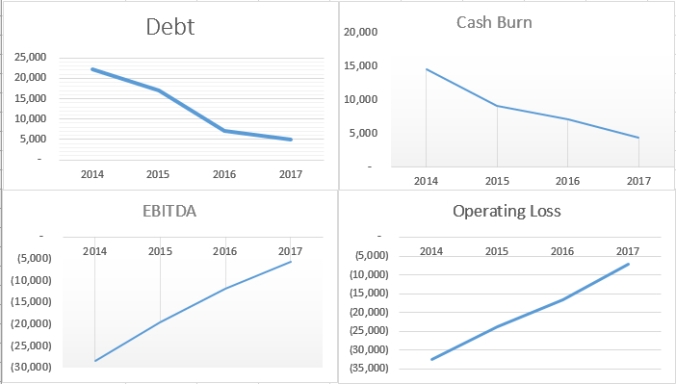

In 2016, we have focused on four key areas that I want to cover. First and foremost we have improved our financial position. Specifically since my joining the company about 18 months ago, our debt is lower by almost 50%. Operational cash burn is lower by 52% and we have a stable capitalization structure and that’s remarkable. These changes will undoubtedly prove their value for the company and the years to come.

Second, we have focused on expanding sales in the healthcare market that is changing and challenging and evolving. Toward the last part of the year in 2015, we adjusted and expanded our sales forces in key geographic areas throughout the United States, some of those personnel changes impacted of our revenues for the quarter, but I’m absolutely confident that going forward once our enhanced sales strategy is fully implemented revenues will stabilize and grow with new distributors.

We are bringing on additional sales professionals to expand and diversify a surgeon and hospital base and we have new data and messaging to support our direct and private label sales going forward.

Point number three, we have advanced and validated our science at worldwide forums thereby increasing the visibility, success and outcomes of silicon nitride. This portfolio publication and science have been instrumental in gaining the attention of other large companies in healthcare and outside, who are now starting to explore our material for their own specific needs. These scientific advancements and visibility will continue this year complemented by clinical reports that we are publishing now that further validate our material claims.

Point number four, we have shown as have others that our material is equally advantageous in non-medical i.e. industrial applications. It’s just as strong as any other industrial material if not better. This expansion into the larger space of non-medical users of our material such as the aerospace industry and electronics industry has just begun, and it’s a very promising development for our future.

Point number 2 concerns sales and it wasn’t until 2017 that sales seem to have “stabilized”. Point 2 is more of a sideshow for Amedica as what really matters is point 3, validating the science, showing Silicon Nitride really does what was once theorized to do.

Point Number 3 & 4: Validating the Science & Material

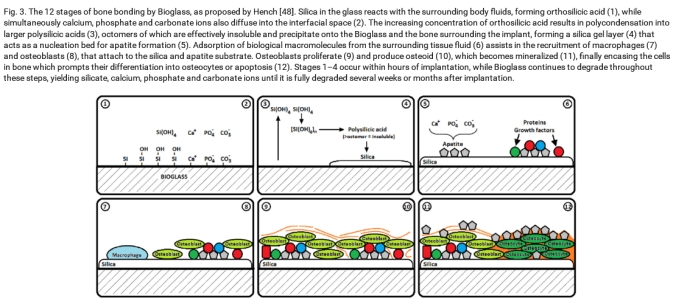

Dr. Sonny Bal, Giuseppe Pezzotti, & Brian McEntire have been painstakingly working to prove that Silicon Nitride is truly Antimicrobial, Ostoeconductive, Osteoinductive, prevents Osteolysis, reduces corrosion, & has minimal affect on the bodies ecosystem; silicon nitride is water soluble allowing the body to evacuate excess silicon nitride. All biomaterials corrode to some extent, so you want an implant material that will have the least impact systematically. The fact that our bodies can evacuate potential buildup prevents issues of toxic buildup that people with metal implants can suffer from.

Proving these things makes Silicon Nitride the leading biomaterial on market in terms of benefits it can offer patients. No other company currently has a product that can do all these things despite competitors trying to modify their materials to provide some of the above benefits. Fortunately Amedica has a solution for them as well, a Si3N4 coating or Si3N4 brazing for metal implants made from second generation Si3N4. Second generation is an enhanced version of Si3N4 that, with a tweak to the surface makeup, can increase the bodies response to the material potentially reducing healing time further.

Dr. Bal, et al have proven the core concepts of Amedica’s material. Now its testing the material with major partners to apply the material to various medical & non-medical applications.

Si3N4 has been proven in-vitro, in-vivo, & clincally. The only thing missing is long-term retrospective studies which was announced earlier this year. I contend that Dr. Bal, et al. have done all they can do to mitigate risk a large company like Zimmer would take on upon M&A with Amedica. This is especially important for a company like Zimmer which may have acquired Trabecular Metal too soon, bitting them in the behind when the recalls and lawsuits began to occur. Given Dr. Bal’s experience with Zimmer & Trabecular Metal I’m sure he’s well aware of this and that may have been what prompted this statement:

Now keep this in mind in every instance we have expressed concerns not that the testing conditions are too harsh but rather that they are not harsh enough. Our material is very competitive and it has been used in industry, in extreme applications where other materials fail. We are keen to put it to the test in every which way, we are open to the most intense testing of our material against any other material in the world by any partner.

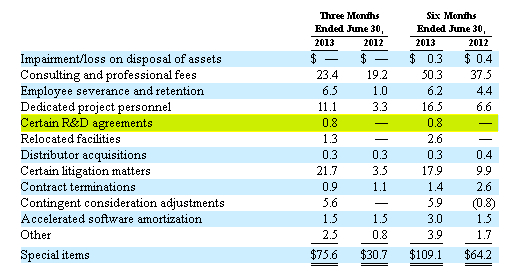

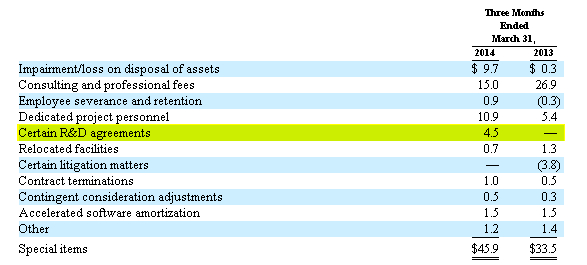

Point Number 1: First & Foremost Improved Financials.

(In thousands)

Dr Bal became CEO of Amedica September 30, 2014. Immediately Dr. Bal began evaluating ways to cut costs. The first round of layoffs occurred Q1 2015 reducing workforce 28%, cutting overhead costs 35%, & reducing manufacturing costs 25%.

We are committed to our shareholders to improving the focus and profitability of Amedica, as these initiatives will strengthen our financial position, and allow us to execute on the development of our core silicon nitride technology,” chairman & CEO Dr. Sonny Bal

You can see the results in the above graphs of Dr. Bal’s agenda. During his 3 years as CEO the companies debt dropped from about 24 million to current 3.6m. Amedica’s cash burn has dropped from ~15 million in 2014 to ~ 4.5m for first 9months of 2017. EBITDA has dropped from 28 million to 5.6m so far 2017. Those are staggering financial changes all done with falling revenue. Revenue is not as important as proving the material. Zimmer can handle unlocking revenue with its huge sales staff.

As someone that works in the accounting world I do like seeing these metrics improving the way they do. I’m pleased with seeing the company running with greater efficiency, squeezing every cost point possible to minimize their impact. That said, what’s confusing to me is, why continue to cut costs while not investing in sales? Why not obtain a new loan for expansion to increase sales & marketing? Is that not what a typical CEO does? Try to grow his business? Why then is Dr. Bal doing the opposite?

Well this is where de-risking the companies financial position comes into play. The purpose is the minimize the companies potential dilutive financial impact on an acquirer and to maximize potential accretive potential in the future.

Earnings Per Share

Analysts, investors and journalists who follow stocks have an obsessive focus on earnings per share, what it is now and what it will be in the future, as can be seen in the earnings announcement game every that takes up so much of Wall Street’s time and resources. Not surprisingly, acquiring firms, considering new deals, put their accountants to work on what they believe is a central question, “Will the earnings per share for the company (acquirer) go up or down after the acquisition?” A deal that will result in higher earnings per share, post-deal, is classified as accretive, whereas one that will cause a drop in earnings per share is viewed as dilutive.

This is what it all boils down to and how management of a company is evaluated, EPS. It should be noted that, after factoring in 2 reverse splits, the initial loss per share was ~$480 per share. So far, in 2017, that loss is just $2.42 per share. That’s a bit flawed comparison but when you factor in both reverse splits, 2014 OS was only 68,000 shares. A better comparison though is 2016 loss of $4.38, a 45% improvement in EPS; does not include a dividend paid out 2016 and is based on current weighted OS.

Consider this for a moment:

If you are buying a company with a lower PE ratio than yours, there is usually a good reason why that company has the lower PE. It could be that the firm is riskier than average, has lower or no growth or is in a business with sub-standard returns. If any or all of these reasons hold, acquiring this company will bring those problems into the combined company and cause the PE ratio for the combined company to fall. If that drop exceeds the increase in EPS, the stock price of the combined company will also fall, notwithstanding the accretive nature of the deal.

Acquisition Accounting I: Accretive (Dilutive) Deals can be bad (good) deals

Amedica has a lower PE ratio than Zimmer. To reduce potential negative impact of a merger between companies, especially since Zimmer is struggling, minimal financial risk is called for.

Debt

Heavily indebted companies rarely represent good takeover targets. Stocks that trade at low multiples and that look cheap, are usually cheap because the company is facing some issues. By buying this kind of company, an acquirer places a bet on its ability to unlock the target’s performance, taking advantage of the low valuation. Acquirers know that they could be overestimating their ability to unlock the target’s performance, that integration between the two companies could be more difficult than expected and that the issues the company is facing could be worse that they appear. Debt, on the other hand, is certain. The higher the indebtedness, the higher the loss if something goes wrong. Acquirers don’t want to risk buying an asset that they can’t take advantage of and that ends up being a drag on cash flows.

As i already stated Amedica’s debt is down to 3.6m and 1.1m of that will be paid off by January 1st 2018. It’s also possible the 2.5m debt is a backdoor payment from Zimmer to North Stadium Investments for Amedica, as confusing as this seems to me. Recall that Zimmer paid $2.5m to an unknown company Q2’17 & North Stadium Investments, owned by Amedica’s CEO Dr. Bal, loaned Amedica an identical amount. A backdoor payment is possible but i certainly do not understand how it works. Anyways, its possible that there is only $1.1m in real debt.

I would like to add, that its odd that Amedica has not been able to or has not tried to obtain a loan to expand operation, as i mentioned earlier. I wonder if this is why:

Another common deal protection is a standstill agreement. A standstill agreement prevents a party from making business changes outside of the ordinary course, during the negotiation period. Examples include prohibitions against selling off major assets, incurring extraordinary debts or liabilities, spinning of subsidiaries, hiring or firing management teams and the like.

As i pointed out in my blog post, Zimmer & Amedica Connections via Personnel, Amedica has hired members to its management team but those members are former Zimmer employees.

Capital Structure

The first thing I look at is capital structure. Good takeover targets usually have a clean capital structure. If a company has large amounts of convertible bonds, several classes of common or preferred stocks or is exposed to “overhang,” the risk of share dilution is much higher, making the stock a less attractive target.

Amedica has no convertible debt, it paid of its senior notes last year, & issued preferred shares from an offering in 2016 have been converted. There are about 1.5 million warrants outstanding with various strike prices however. In the scheme of things these shares will not impact EPS as badly, especially now after the reverse split. The warrants will provide a small injection of capital into Amedica’s coffers, ~$15 million, which would allow Amedica to retire all debts after announcement of M&A; this assumes of course funds exercise after announcement. Amedica’s small, fully diluted, share count would minimize the initial dilutive impact upon closing of M&A and increase potential accretive impact in the future as compared to before the reverse split.

Conclusion

Based on the evidence i’ve collected, i am confident in saying that Dr. Bal’s modus operandi is simply to de-risk Amedica to the fullest extent of his ability. Dr. Bal et al have worked extensively to run medical grade silicon nitride through the ringers to ensure that the material not only does what is expected but that there is are no negative surprises. While de-risking the material, Dr. Bal has spent his 3 years as CEO insuring that Amedica’s financials are as pristine as possible before M&A. I can see no other purpose of his pursuits outside of preparation for acquisition.

For years they’ve leased 56,000 sq ft building only occupying 30,000 sq ft of it. In 2017 that changed and now they are leasing sub-sections they do not use. Almost as if they do not plan to occupy it much longer.

For more research on this check the following links:

For some outstanding research on lack of annual meetings & executive compensation: